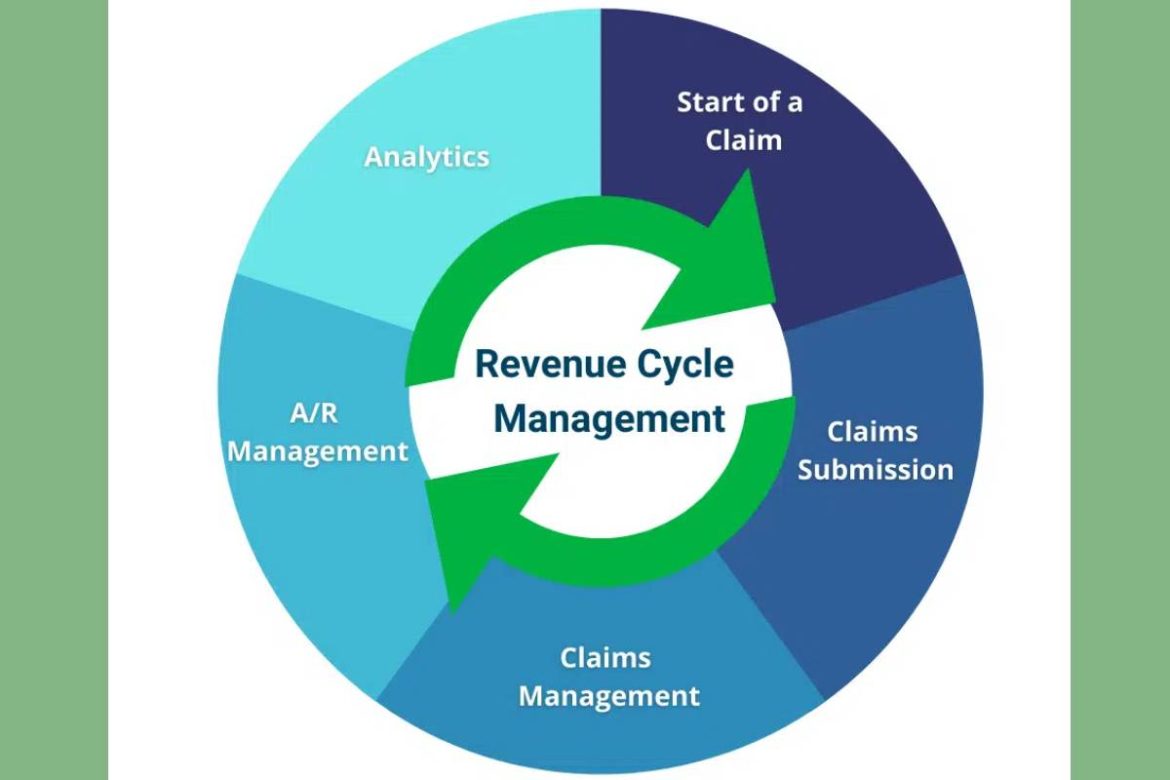

Healthcare Revenue Cycle Management – Revenue cycle management (RCM) is a technique employ in the healthcare industry to keep track of and collect money from patients. RCM is involved from the time a patient’s appointment is scheduled to the time the bill is paid.

Revenue cycle management is becoming increasingly difficult for health systems as they merge, acquire additional providers, and navigate the shifting environment of payers.

Over 76% of health systems surveyed by HIMSS Analytics cited denials as their top revenue cycle difficulty, followed by revenue integrity (368%) and patient pay (342%). C-level healthcare executives often become bogged down in the details of the revenue cycle and fail to take a long-term view.

Consider these seven revenue cycle and office management best practices to achieve financial success.

1. Proper Registration

Claim denials can put a strain on business office workers. It is possible that registrars and appointment call staff are not collecting appropriate insurance information during patient onboarding, resulting in misleading denials of service. Call centres should gather and securely input patient insurance information when patients book appointments.

In addition, use a financial clearance team at least one week before the visit and verify insurance for all scheduled interactions. Staff should check for expired patient identification and insurance cards during the face-to-face registration process.

Add re-education to these easy actions by emphasizing the significance of accurate insurance data and the potential financial harm resulting from human error. Just a few extra minutes spent by front-end registration employees can save a lot of time and money in the long run by preventing unjustified denials and resubmitting claims.

2. Center the Procedure around the Patient

The necessity for effective patient relationship management is recognize by healthcare practices that maximize their RCM. The patient becomes more loyal to the practice if the team takes proactive steps to promote patient satisfaction and create a strong relationship.

Both verbal and written information should be provided to the patient regarding the patient’s financial responsibility as well as payment options. Medical billing may be a frustrating and confusing experience for patients. The more time spent talking to a representative about it, the more likely they will pay back the provider.

3. Utilize Technology

If you file a claim to Medicare or Medicaid, it may appear that it will automatically refuse it. In the absence of technology to keep you abreast of diagnostic codes and payer regulations, this may be the case. It’s possible that you’ll get repaid less than what you originally submitte.

Reviewing underpaid claims, repair problems, and resubmitting them takes time. The costs rise even further if your practice is subject to a Medicare TPE. Prior authorizations, admissibility, medical coding, and billing can be streamlined by automated software solutions that alert you to problems before claims are submitted. Your claims will be process more quickly and efficiently if your insurance company uses the most current technology and automation.

The front office is a good place to start when it comes to reducing refused claims, but everyone on the team should be aware of the requirements for an accepted claim.

4. Automatize Prior Approvals and Eligibility

The first step to a successful RCM is verifying insurance coverage at patient registration. Pre-authorization and coverage eligibility rules are becoming more stringent as insurance firms seek to protect their customers against scams.

Due to the increased standards, payment is likely to be slower, and many more claims may be denied as a result. It is possible to speed up the revenue cycle and reduce the time spent by front office workers by automating prior authorizations and eligibility.

5. Denial-Based Strategy

When these standard practices are not followed, claims may be refused. A hospital or medical practice’s ability to track and analyze denials is essential to identifying patterns and uncovering the core causes.

To minimize the risk of denials, a program focusing on standardizing processes should be create for the entire staff. Denial management programs can minimize A/R, boost cash flow, decrease rejections volume, and cut the cost to collection rate by using best practices.

6. Enhance Charge Capture and Encoding

It’s critical that healthcare facilities and practices devise and also, implement methods for efficiently collecting fees for the services they provide. Outpatient nursing treatments, such as IV therapy and injections, commonly suffer revenue losses as a result of inadequate nursing documentation. Missing charges or inaccuracies in reporting units cost pharmacies money.

The nursing and pharmacy teams should evaluate charts and claims for missed charges; submit accurate nursing documentation with start and stop times, locations, and medications; and regularly review pharmacy charges to identify the proper reporting of pharmacy dispensing units.

7. Monitor Key Indicators on a Regular Basis

When it comes to filing and billing insurance claims, it is important to keep an eye on any anomalies that may arise. Take a look at how often patients miss appointments despite repeated reminders and how often claims are denied, and the reasons for that are all things to keep an eye on.

For example, using high-end technology and tools for revenue cycle management, so you can outsource the process to them. You can concentrate on what you do best and not be distracted by the micromanagement of your healthcare business’s medical billing and coding systems if you outsource this duty.

Moreover, many healthcare businesses fail to submit claims on time and miss deadlines. Many commercial insurance companies only allow 90 days for filing claims from the date of service, whereas Medicare permits one year from the date of treatment for this. Unpaid claims force the practice to write off healthcare services if deadlines aren’t met. To meet these deadlines, it’s critical to have procedures in place.

Conclusion: Final Thoughts

It only takes a few modest moves in the correct direction to go a long way with RCM. Having a well-established and optimized RCM process ensures that your company’s income and financial health are always on track. And collaborating with the best in the field can save you time, energy, and money without sacrificing the quality of clinic administration or patient care.